Gunnison County may miss the brunt

As the sub-prime mortgage collapse sweeps the nation, local housing experts and real estate agents are optimistic that the local market will be somewhat insulated from its effects. However, credit woes that result in fewer housing starts and sales could send financial repercussions throughout the valley.

The extension of the easy credit and adjustable interest loans has plunged thousands of financially over-extended borrowers throughout the nation into bankruptcy. The sheer volume of loan defaults has already sent ripples throughout the world’s financial institutions, and most experts believe that the worst is yet to come.

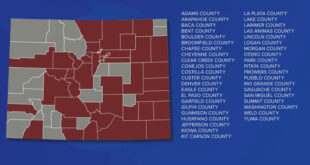

Much of Colorado’s recent housing boom has been fueled by the easy-to-acquire high interest loans, and as a consequence, the state is among the highest in the nation in foreclosures.

According to the annual report on state lending issued by the office of Colorado attorney general John Suthers, high-risk borrowing has reached dizzying heights in Colorado. The report suggests that the problem is so widespread that even areas without significant sub-prime lending activity are being injured by the fallout.

Mirroring much of the rest of the nation, Gunnison County has seen an upsurge in foreclosures this year. The 24 foreclosures so far in 2007 have more than doubled the rate of 2006.

However, 2005 was closer in defaults to 2007, so it may be too early to tell whether this year’s increase signifies a trend, according to statistics furnished by the county treasurer’s office.

Western State College (WSC) economist David Plant is one expert who believes the effect of the surge in defaults is likely to be felt across the board—including Gunnison County.

“It’s impacting the entire economy,” he says.

Plant says those effects range from a weaker dollar, which will raise consumer prices on imports, to less cash on hand for local entrepreneurs and investors. “It’s making it harder to borrow,” he says.

While he isn’t sure that a recession will be the end result of the mortgage meltdown, he says there is no question that the economy has hit a rough patch and it probably hasn’t bottomed out yet.

Plant’s colleague, WSC economics professor Sally Hays, concurs. “I think it’s going to have a ripple effect—definitely,” she says. “There’s a lot of fear that it will affect consumer confidence,” she adds.

While both economists agree that the national picture doesn’t appear rosy, there may be reasons why Gunnison County is insulated from the worst of a possible recession.

For one thing, Plant says many of the region’s home sales are not speculative.

“People actually want to live here,” he says.

Another thing that could work in the region’s favor, according to Plant, is that the local economy is primarily based on tourism.

“I think we’ll weather the downturn in the housing industry pretty well,” he says. “I’m more afraid that global warming will hurt the tourism economy,” he adds.

Gunnison Country Association of Realtors president-elect Darci Gillespie says all real estate markets are local. She expects this market will be resilient to the rest of the nation’s credit woes.

“We have a lot of second -home purchasers,” she says, “and they’re paying cash.”

Community Banks of Colorado mortgage broker Michelle Phelps says she thinks lenders in this region do a good job of educating their customers about the perils of adjustable interest loans and financial over-extension. Unfortunately, she says, the rest of the nation’s problems have made it more difficult to borrow money here.

She says prospective borrowers shouldn’t be deterred, however. “There are still a lot of good loan packages out there,” she says.

Attorney general Suthers says in his report that borrower education is part of the key to ameliorating the crisis.

“We must continue to educate Coloradoans about the dangers of borrowing at exceptionally high interest rates, and show our citizens how to avoid the cycle of debt that plagues so many,” he remarked.

Stephanie Aeschliman, Gunnison County Housing Authority’s house buying counselor, offers classes for local residents borrowing for new homes.

“In our classes we cover predatory lending and what people need to watch out for,” she says. “Just because you are pre-approved for a loan with a payment that is 60 percent of your income doesn’t mean you can afford it,” she adds. “We advise that your total housing costs shouldn’t exceed more than 30 percent of your income.”

The Crested Butte News Serving the Gunnison Valley since 1999

The Crested Butte News Serving the Gunnison Valley since 1999