Opposition calls it good news

At least one stock analyst is telling his subscribers to bet on Kobex Resources Ltd. pulling out of the Lucky Jack project within months. However, the company has given no indication thus far it will do so.

Kaiser Bottom-Fish Online owner John Kaiser suggested to his subscribers via email on Monday, March 10 that they should buy Kobex stock now. Kaiser believes Kobex president and director Leo King and chairman and director Roman Shklanka will cut their losses on the Lucky Jack project and pursue another, more profitable, project elsewhere. The stock is being traded on the TSX Venture Exchange.

“I think they’ll give up on this and find a new project,” Kaiser said in a phone interview from his California-based office. “Then they can do what they’re good at, which is adding value to the underlying asset.”

Kobex chief operating officer Maurice Tagami said he had no comment. “Everyone is entitled to their opinion,” he said, noting Kaiser is an analyst and not affiliated with Kobex.

In 2006, Kobex Resources, a Canadian-based junior resources company, signed on to partner with Lucky Jack owners U.S. Energy Corp. to develop a molybdenum mine on Mt. Emmons, which neighbors Crested Butte. Under terms of the agreement, Kobex operates the project, and has the potential to earn at least 50 percent and up to a 65 percent interest in the project. Last spring, Kobex put together a “bought deal basis,” which raised more than $28 million in capital.

According to Kaiser, Kobex has already spent approximately $8 million on rehabilitation at the existing Keystone Mine, studies of the metal at the site, and investigating the ore deposit.

Kaiser specializes in researching high-risk speculative Canadian securities with an emphasis on the resource sector. He’s worked in the field since 1983.

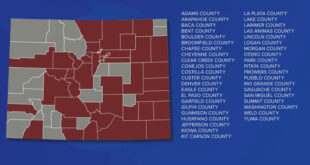

Now, he says, the company must decide whether to spend $14 million on the new tunnel project—or “drift” in mining parlance—that it needs to prove the ore body’s value. While the state of Colorado has approved the tunnel, the matter is now before Gunnison County and its separate permitting process—and the Town of Crested Butte also has permitting authority.

In addition, High Country Citizens’ Alliance has asked state authorities to review its decision.

According to Kaiser, with approximately $23 million in working capital left and increasingly impatient stockholders, he’s betting the company will decide to move on. “The market is giving no value whatsoever to the Lucky Jack Project,” he says. “What the (stockholders) are saying is ‘We have no hope whatsoever that you’ll ever solve this.’”

That message has translated into a poor stock price—it was trading at $3.50 in 2007 but is now down to 65 cents. Kaiser says the multiple jurisdictions that have sway over Lucky Jack permitting are driving the low stock price. “If permitting were a matter of course, Kobex would be a $5 to $10 stock at this stage,” he wrote in a release. “But the stock is in the 50 cent to 75 cent range instead because the market has concluded that Kobex is doomed to spend its time and money on a futile quest.”

Lucky Jack community liaison Perry Anderson said he wasn’t aware of Kaiser’s findings but the company obviously knows its stock is low. “But typically all mining stocks are slow at this time,” he said, noting that mining stocks are often cheaper in winter but rebound in the spring.

Tagami says, “I don’t think it’s any secret that the progress hasn’t been as fast as we’d like to see.” He says the company has been telling shareholders that they knew opposition existed and are working diligently to provide good information to the public. “We also tell shareholders that the deposit isn’t going anywhere,” Tagami says.

As an analyst, Kaiser thinks Kobex management underestimated local resistance to the project. “I think they thought that small company approach might be able to overcome the opposition,” he says. “What they didn’t understand is that the rules for permitting in Colorado aren’t mine-friendly and this could be dragged on for some time… They’re now glumly aware that this is much, much more difficult.”

However, Kaiser cautions that the company could take the risk because, “The prize is enormous. The core is worth $6 billion and the overall value is $36 billion at today’s prices.”

In addition, he said, even if Kobex withdraws its participation, the mine will still be in the hands of U.S. Energy Corp., which is a larger company in a better financial position. Kaiser points out that U.S. Energy has the luxury of time, unlike Kobex.

Red Lady Coalition board member John Norton says Kaiser’s position is good news for those fighting the Lucky Jack project. “Kobex seems to think that with the Lucky Jack, it’s all blue sky,” he says. “It’s encouraging to hear that an analyst like Kaiser recognizes the giant hurdles in the regulatory process—at the federal, state, county and town levels.”

With opposition from the Coalition and High Country Citizens’ Alliance continuing, Norton says, “We all believe that Kaiser is right in concluding that this is a process that could go on for 20 or 30 years, or longer.”

HCCA mineral resources director Bob Salter says Kaiser’s thoughts seem to make sense and he hopes Kobex will pack up. “It would be very wise of them to do that because we are going to fight them every inch of the way,” Salter says.

The Crested Butte News Serving the Gunnison Valley since 1999

The Crested Butte News Serving the Gunnison Valley since 1999