Industry plans campaign to defeat measure

There may be more money available for college scholarships and renewable energy projects if voters approve changes to the state’s method of charging severance taxes on oil and gas industry activities this fall. However, industry representatives say the measure, if passed, would more than double their current taxes, and could lead to an increase in the price of products such as natural gas.

Supporters of Initiative 113 and the A Smarter Colorado campaign are proposing a measure that would eliminate a severance tax credit that oil and gas companies receive by paying local property taxes. Supporters say the measure will raise $321 million a year in severance tax revenues, with the increase in funds specifically being allocated for college scholarships and renewable energy projects, among other things.

On Monday, August 4, campaign officials turned in a ballot petition with 136,000 signatures, according to Environment Colorado legislative affairs director Pam Kiley. The state requires 75,000 signatures from registered voters to approve a citizen-initiated ballot measure. The signatures have not been reviewed yet by the state.

A report released by the oil and gas industry on July 7 says the industry will face a 137 percent jump in taxes if the measure is approved. The report indicates that consumers will likely end up paying more for oil and gas products due to the tax increase, but does not specify how much.

Gunnison County commissioner Hap Channell says the measure is an increase in the effective amount of severance tax revenues, but should not be considered an increase on the taxing rate itself. “I think that’s an important distinction to make… Corporations pay severance tax for extracting resources, and they receive a credit against that for paying property tax. We’re talking about removing the credit.”

The state legislature has been discussing how to make changes to the state’s severance tax since last fall, when the legislature authorized an interim committee to discuss the issue. The state also authorized a handful of citizen working groups, comprised of non-assembly people, to develop similar strategies. Channell was in one such group. “The two groups worked through summer and fall to make recommendations,” he says. “We have been noticing how small our portion of severance tax dollar was, and we were out to make it fair.”

Channell says one of the topics was the re-distribution of funds, “so funds would return to the counties of origin.” They also considered raising the tax rate, but keeping the credit.

Earlier this year, representative Kathleen Curry (D-Gunnison) unveiled a measure that would also do away with the tax credit, but one that did not contain the same distribution formula as the latest proposal. “On the spending side I would have had a higher percentage of dollars going to impacted areas,” Curry says. Her measure also would have given money directly to colleges and universities to pay for capital improvements, rather than a scholarship fund.

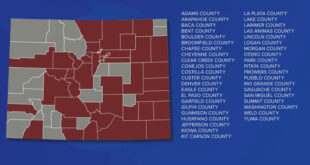

Channell doesn’t have much of an opinion on Initiative 113. He says it’s unlikely to hurt the county if passed—if anything, it will help. “My interest is more, what does it mean to local government, in particular to the counties of origin. The 16 counties that produce most of the severance tax dollars don’t get anywhere near the percentage they produce,” Channel says. He says the county sees severance taxes as an important revenue-building opportunity, but the taxes currently don’t have a big impact on the county’s budget.

There was some success with HB 1083, a bill sponsored by Curry that passed earlier this spring. “Gunnison County stands to benefit from that,” Channell says. “They’re attempting to put more of the severance tax dollars into impacted counties.”

HB 1083 will make changes to the way funding is directly distributed back to counties by the state, allocating a higher percentage of funds to counties where oil and gas companies employees reside and where permits are issued. The bill does not change the amount companies will be taxed. Half of all severance tax funds are distributed through a Department of Local Affairs Grant Program, which counties equally compete for.

The one downfall to HB 1083’s funding scheme, Channell says, is the county where the oil and gas employees reside is not always the same as the one from which the resources are being extracted. For instance, many of the employees of oil and gas wells functioning in Gunnison County live in Delta County.

The industry is beginning a multi-million dollar campaign to battle Initiative 113. Channell is skeptical about claims the industry makes, such as an increase in prices, and a decrease in production.

“If you compare our effective severance tax, even after this initiative, with surrounding states, I don’t think you’re going to see a significant reduction of product, nor a wholesale fleeing (of the industry) from the state of Colorado. Where are they going to flee to?” Channell says.

The Crested Butte News Serving the Gunnison Valley since 1999

The Crested Butte News Serving the Gunnison Valley since 1999