Bond would be safety net if Proposition 61 passes in November

There’s a toll to take the safe road, and the Gunnison Watershed School District could end up paying that to the tune of $400,000 a year if Proposition 61 passes in the November election. That’s on top of needing to take out a $1.5 million loan just to make payroll through the end of the year, whether or not the measure is approved.

Proposition 61, if passed, would stop the county from borrowing money, period. The state’s Interest Free Loan program has gotten the district through the lean months of the year until property taxes come in the spring. But, with the amendment looming, that program has been put on hold.

School district business manager Stephanie Juneau is moving ahead with preparations to offer a certificate of participation (COP) of as much as $5 million in November if the measure passes and has already spoken to one local bank about the loan.

Juneau explained a Certificate of Participation as something that will work a lot like a mortgage on a house. The district will identify the amount of money that they’re going to need and an equivalent piece of property to collateralize that.

The property, Nelson thought, that would be worth the closest to the $5 million mark is likely Lake Elementary, which will go up as collateral.

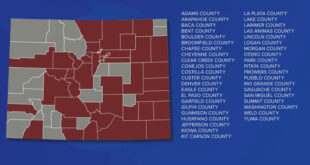

Propositions 60, 61 and 101 will be on the November ballot and have most government officials on edge. All of them affect the way the school district, or any governmental entity, gets its funding, through property taxes, borrowing or ownership taxes.

“We need a short-term loan in place to make sure we can make it through October and November for payroll, regardless of what happens with the election,” Juneau told the school board on Monday, August 23, “and then long-term I strongly encourage you to move forward with preparing documents for a certificate of participation. And while that’s a costly endeavor, it’s in our own control.”

Having that control could mean going to market with a $5 million offering between November 3—after the verdict is in on Proposition 61—and December 31, before the amendment would take effect January 1. The bank that has taken care of the district’s interest free loan in the past will be handling the COP and the district won’t have to pay for that preparation until the COP is sold.

Juneau said, “The district then has the cash to make it through the cash shortfall season until the property taxes come in the spring. When the property taxes come in, we simply put that $5 million into an escrow account to hold onto until the following winter into spring. So we would become our own little loan system that we would borrow that money from and against.”

Because issuing a COP is a lengthy process, Juneau said, “You’d really be taking an unwise gamble if you waited until after the election to make a decision” on the COP.

Paying the COP back over 20 years would cost the district about $400,000 a year. That money would come out of the district’s operating budget. Board member Jim Perkins summed it up by saying, “Eight teachers.”

He continued, “In a time of potential undercuts, it’s basically another cut from the budget. When you put it in terms of teachers, it means increasing class size and everything else. But what’s our choice?”

The choice was one the board couldn’t stomach: Putting a question on the ballot to increase property taxes countywide to pay the $400,000 financing costs.

“Talk about a rock and a hard place,” Perkins said.

And the board’s initial reaction to being in such a tough place several weeks ago was to propose an amendment of its own that would essentially counteract the debt-limiting effects of Proposition 61.

But Juneau had come with a resolution to cancel the district’s participation in the November election.

She told the board that if they were going to spend the time and energy campaigning, they should do it to oppose the dangerous propositions on the ballot instead of trying to get people to vote for a counter-measure.

“Or you could pass a resolution to cancel the election and move forward with the certificate of participation,” she said, leaning heavily toward the latter.

Regardless of whether or not Proposition 61 passes in November, the district will need to borrow around $1.5 million to make payroll through October and November. The interest on that loan would probably not be any more than $13,000.

On the other hand, Juneau didn’t think an election would cost the district anything less than $17,000. The district could end up footing the entire election bill if no other taxing entity submits a question for the ballot and that could cost as much as $25,000 to $30,000.

The board also considered asking voters for a mil levy override in 2011 as another way of covering that $400,000.

“It makes the most sense to us to take the two precautions leading up to the November election, making sure that we have the short-term solutions in line and number two that we have the long-term solution taken care of, even though it’s not the ideal solution,” superintendent Jon Nelson said.

The board, with a quorum of only three, voted to cancel the election with the counties. Juneau will return to the board once she has the terms of the loan from the bank, possibly by the board’s regular meeting September 13. The meeting October 4 will likely be spent signing documents for the short-term loan.

The Crested Butte News Serving the Gunnison Valley since 1999

The Crested Butte News Serving the Gunnison Valley since 1999