Woods’ bank in the spotlight. “We are confident this will be resolved…”

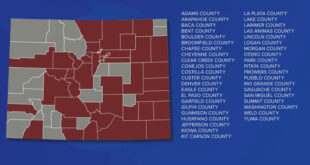

Community Banks of Colorado, which has branches in Crested Butte and Gunnison, is under scrutiny from federal banking regulators. The bank franchise has received a “Prompt Corrective Action Directive” from the Federal Reserve stating that it needs to bring in more equity or sell to another bank. The bank has until early May to show significant progress.

Chairman and CEO of the bank and the holding company Donald Woods says he’s confidant the situation will be remedied.

The five-page Fed document indicates the bank is “significantly undercapitalized” and is co-signed by Woods.

“We have 38 branches around the state with many in resorts where the real estate market has been severely hurt,” explained Woods. “We have loans collateralized with real estate that has lost value. As those real estate values go down, our need for capital loan-loss reserves goes up and so regulators are requiring us to get more equity.

“We are talking to qualified, well-funded investors and are pretty far down the road with several groups,” Woods continued. “The Fed has the ability to extend the timeline and that’s what we expect to happen.”

Woods said the directive from the Fed was received February 8 and gave the bank a 90-day timeline to work out a plan. “The 90 days is not a deadline to have a completed plan but to show significant progress. It’s a reporting deadline, not an action deadline,” Woods said. “The board of directors is taking this seriously and we understand the need to raise equity. We are working with potential investors and we are confident we’ll get the capital into the bank and it will be business as usual. The regulatory process will probably extend that beyond the 90 days. But the bottom line is that we have a plan; we are executing that plan and we believe we can perform. It just won’t likely be completed in 30, 60 or 90 days.”

Woods emphasized that bank customers have little to worry about. “There shouldn’t be much concern from that perspective,” he said. “We have a good, strong banking franchise that is attractive to investors. Even in a worst-case scenario, there is no danger or risk to accounts with the federal FDIC insurance if customers have arranged their accounts properly. The federal insurance is the backstop. There is almost a nonexistent risk to the customer.”

Woods cited real estate devaluation in places like the Gunnison Valley, Telluride, Vail, Aspen and even metro Denver that added to the bank’s woes. “It wasn’t just one market,” he said. “The second homeowner markets have been hit harder than others.”

Community Banks is regulated by the Federal Reserve and the state of Colorado. “The state is more understanding,” Woods admitted. “The Federal Reserve is our primary regulator and they have been more demanding but we have to respond to their rules and regulations. They have given us 90 days to make significant material progress toward raising equity. We have been working on this for over a year and we are pretty far down the road with discussions with some groups. I believe we’ve made that material progress. A number of groups are doing their due diligence.”

No specific amount of equity has been set by the regulators to be obtained. “They just say you need more equity. There are many variables that they consider so there isn’t a specific number. It becomes a negotiation with the investors, the regulators and the current shareholders. At the end of the day, we need regulatory approval and so they’ll review our new capital plan.”

The Woods family is the primary shareholder of the bank but there are more than 400 total shareholders. “We don’t know what the make-up of the shareholder situation will ultimately be,” he said.

“Again, I want to emphasize that there are no restrictions on how we deal with customers,” said Woods. “A lot of investors would be interested in a franchise like ours. But we want to stay consistent with our community banking philosophy. The investors we are still having discussions with are those which appreciate community banking.”

The bank must have an official response back to the Fed by early May.

The Crested Butte News Serving the Gunnison Valley since 1999

The Crested Butte News Serving the Gunnison Valley since 1999