Making it more expensive for the local Vape Lords and Vape Queens

by Mark Reaman

The Crested Butte Town Council is trying to figure out how far to go with a proposed tax on cigarettes and nicotine products that will be put to the voters this fall.

The state recently allowed municipalities to impose a tax on cigarettes, tobacco and nicotine products, including delivery devices, if voters approve the measure. The Crested Butte town staff is proposing an election question that would include a $3 tax on each pack of cigarettes sold in town and a 40 percent tax on all other tobacco and nicotine products. The council is debating whether to exempt the delivery devices that would include things such as vape pens and pipes from the tax.

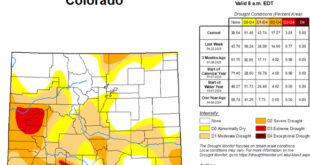

Town finance director Rob Zillioux estimated the tax could bring in another $150,000 annually to the town coffers. “But part of the goal of this is to deter youth from using tobacco and nicotine products,” he said. “For some reason Colorado is a big state in terms of vaping, especially with kids.”

“Weed isn’t cool anymore,” said Crested Butte councilman Will Dujardin. “Being a vape lord or vape queen is what’s cool.”

“My concern is that this 18-to-21-year-old group will just go to Mt. Crested Butte or Gunnison and buy it there,” said councilwoman Laura Mitchell. “We’re just pushing it off.”

Zillioux said the communities in the Roaring Fork Valley that passed a similar tax reported a slight decline in the volume sold.

Local businessman John Penn of The Tobacconist raised heavy objections to the proposal. “Everything you are talking about will put me out of business,” he told the council at the July 2 meeting. “It takes an $8 cigar and turns it into a $15 cigar. Tourists won’t accept this. These are all personal choices. And the people who vape don’t buy cigarettes. All this money you talk about collecting, how will it help me pay my rent? My business is already heavily taxed. What’s next? Taxing CBD? Taxing incense because some people don’t like the smell? Putting a 40 percent tax on paraphernalia? Where would that leave me? I’m unhappy about this.”

“I’ve heard from local retailers who sell cigarettes that they think a $3 tax per pack is too much as well,” said councilwoman Candice Bradley.

“It would be very tough on John’s business,” agreed councilman Paul Merck.

“No offense to your business, John, but to me this is about health,” said mayor Jim Schmidt.

“Health? You guys push alcohol like crazy in this town,” responded Penn. “It’s all over your website. You want to talk about health? It’s choices and you choose to promote alcohol in this community.”

Kyle Tibbett, tobacco health educator with the Gunnison County Health and Human Services Department, said statistics show almost 30 percent of local kids report using vapes. “It’s been shown that price increases will have the largest impact on deterring youth, not so much the tourists or older users,” he said.

“What’s the problem we’re trying to solve with this?” asked councilman Chris Haver, who has expressed his opposition to the tax proposal. “At first it was to address local kids who were vaping and juuling. I question raising the cigarette tax. It’s taking a sword to an issue we can deal with by using a scalpel.

“I’m against this tax,” Haver continued. “I don’t see it as us being a leader in the community. Kids will still get the product elsewhere. Kids here have money so I don’t think it will be a deterrent in Crested Butte. Raising prices for everyone to try to deter kids in town from using tobacco is just too much.”

Dujardin asked Haver what his “scalpel solution” would be.

“I’m not sure. Maybe we ban vapes,” he said.

“Maybe we target the tax so it doesn’t do things like tax a pipe,” added Bradley. “That seems too general.”

“The tax is a tool,” responded Dujardin. “A 40 percent tax on vaping addresses vaping. It feels like cost would make a difference.”

“This doesn’t just target vapes,” said Bradley. “So a bong or a water pipe would be taxed at 40 percent too. It feels like it is trying to hit everything.”

Dujardin responded, “I hear what you are saying but we’re here for the health and safety of the community and trying to prevent kids from accessing it helps. Are you thinking less of a tax? I want to enact something in this community where we have a school.”

“I agree with Will,” said Schmidt. “And remember that we will be leaving it up to the voters since they will decide whether or not to pass the tax.”

“What’s the difference between this and trying to get kids to stop drinking alcohol?” asked Haver. “Yes, a lot less people smoke cigarettes so it will be easier to tax it. What if it was specific to juuling or flavored vaping products?”

A motion to approve the comprehensive language in a resolution to propose the tax to voters this fall was made. Schmidt asked if anyone on the council wanted to amend it. No one, including Haver and Bradley, made any suggestions to pull back on the broad language. The motion was passed 4-2 with Schmidt, Dujardin, Merck and Mitchell for it and Haver and Bradley voting against it. Councilwoman Mallika Magner was not at the meeting.

Following the meeting, MacDonald sent the council a memo saying staff would provide them with some alternative ballot language at the next meeting that exempted delivery devices such as e-cigarettes and pipes from the tax. “For example, this would mean that nicotine cartridges would be subject to the tax, but vape pens would not; loose tobacco would be subject to the tax but rolling papers would not,” MacDonald suggested.

The council will continue the discussion at the July 15 meeting.

The Crested Butte News Serving the Gunnison Valley since 1999

The Crested Butte News Serving the Gunnison Valley since 1999