Town Council considers asking for tax increase

A million dollars could be spent repairing Mt. Crested Butte’s curving system of roads and the town would still be left with cracks, potholes, and settlement erosion problems to fix, officials say.

The Mt. Crested Butte Town Council may approach voters this November with a property tax increase to help offset the cost of yearly road repairs, along with funding other everyday projects the town needs to complete.

In the past five budget years, Mt. Crested Butte earned positive revenues three times, according to finance director Karl Trujillo. Last year, the town budgeted for a shortfall of $141,304, and in 2008 the town expects another shortfall of $192,000.

Besieged by an unpredictable revenue stream, and with $556,000 in reserves expected to be left over for 2009’s budget (down from $1.9 million in 2006), the town is drafting a five-year financial plan that should balance the budget with a steady revenue source.

Two ideas the Town Council is considering are a mil levy increase to bring in more tax revenues, and carrying large bonds to cover several big, much-needed projects, something the town has done successfully in the past.

While more than two-thirds of the town’s revenues come from sales tax, according to town manager Joe Fitzpatrick, good portions come from the town’s mil levy on property values and from construction impact fees.

On Wednesday, January 2, Mt. Crested Butte town staff and the Town Council discussed a draft of the five-year financial plan during a work session. Council member Mike Kube explained that while the town has seen some large profits in big construction years, the revenues generated from property sales and construction fees are just a windfall—they’re not a stable source of income.

"We need to do something to keep the town sustainable," Kube said, "but at the same time we want to keep upgrading so we’re a town that’s relatively in the 21st century."

Fitzpatrick said the most logical source of steady revenue would be from the mil levy on property values, also referred to as annual property tax. "We have to have a solid base of income and the answer is a mil levy increase," Fitzpatrick said. He said the town is backlogged with critical public works projects like roadway improvements and maintenance that need to be completed.

Mt. Crested Butte’s current mil levy is set at five mils. The five-year financial plan suggests an increase of another five mils. According to Fitzpatrick, on a home with an assessed value of $1 million, the five mil increase would cost the property owner an extra $33 per month.

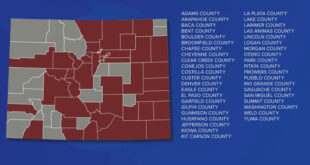

Council member Danny D’Aquila asked what Mt. Crested Butte’s mil levy was like compared to other resort towns. "I don’t think we’re anywhere near them," he said.

D’Aquila said he had spoken with many second homeowners who reported their Mt. Crested Butte property taxes were a drop in the bucket compared to property taxes in their home states.

Mt. Crested Butte mayor Chris Morgan said knowing what other resort towns were charging through their mil levy "would be good information to have."

Council member Tom Steuer said, "It’s going to be a big question among voters where Mt. Crested Butte stands on its mil levy compared to other resort communities." Steuer said if it turns out Mt. Crested Butte is much lower, then there is a better chance of passing a mil levy increase.

Morgan said the town would also have to form a public education campaign to demonstrate the necessity of the increase. "I get the impression that people are against raising taxes until you change their mind. They ask, ‘What do I get?’" Morgan said.

D’Aquila agreed, but asked if the increase would cover the costs associated with the town’s proposed aquatic center.

Fitzpatrick replied, "No, that’s still a looming question."

Kube said he was uncomfortable pushing for a ballot issue for the upcoming April election and thought the November election would allow more time for research.

Kube said any revenue increases as a result of the property tax question would not come until the end of 2009.

Fitzpatrick said of the plan, "By 2012, it starts to look pretty good and we’re in a better position."

As another avenue, D’Aquila suggested taking bonds to cover large public works projects. D’Aquila said the town has been able to make improvements by this means before.

Steuer said that method was not quite as attractive. "Then you’re constantly in the catch-up mode and you’re never on top of it," he said.

D’Aquila then asked if there had been a recent review of the town’s impact fees—fees charged to developers to mitigate the impacts and damage caused by large projects.

Fitzpatrick said there had not been a review for several years, "But again, it’s not sustainable cash. What we’re suggesting is to be able to get out from under that dependency."

D’Aquila agreed that a mil levy was the soundest option, but noted that impact fees were still something to consider. "Some of the problem is not getting enough for growth paying its way," he said.

Another work session to discuss the town’s financial plan is set for Tuesday, January 15.

The Crested Butte News Serving the Gunnison Valley since 1999

The Crested Butte News Serving the Gunnison Valley since 1999