Taxing those who choose to use…

The Gunnison County Substance Abuse Prevention Project (GCSAPP) is lobbying for public support to get an excise tax imposed on retail marijuana sales in Crested Butte and Gunnison that would be earmarked for a “substance abuse prevention fund.”

GCSAPP executive director Matthew Kuehlhorn is sending out a public plea for citizens to ask their council representatives to place a question on the November ballot that would allocate a 3 percent excise tax on retail marijuana sales.

Kuehlhorn plans on coming before the Crested Butte Town Council on June 16 and the Gunnison Town Council on June 17 with the formal requests.

In a public email he sent, Kuehlhorn states: “We are requesting your voice in an important conversation for our valley. In both Crested Butte and Gunnison, there is an opportunity to establish a sustainable revenue stream, by using marijuana excise taxes that could help create a Substance Abuse Prevention Fund, in both towns. This fund could then be used to support our local efforts with proven track records in prevention—some organizations could include Gunnison Valley Mentors, GCSAPP, Parks and Rec Programs, RMBL, RE1J Schools, Mountain Roots and more. We can influence if the excise tax question gets on the ballot this fall—and if it does, we can influence how this money gets used.”

Kuehlhorn said the idea of tying retail marijuana sales to drug prevention programs for kids makes sense.

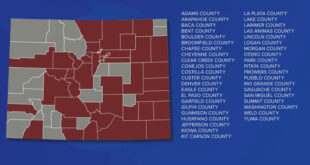

“Many towns in Colorado are passing excise taxes on this industry,” said Kuehlhorn. “I am not sure why the tax had not been looked at initially when Crested Butte placed the ordinance together. Many towns in Colorado have been passing 5 percent excise taxes on retail sales. This generates quite a bit of revenue. A rough estimate in Crested Butte would be that approximately $100,000 could be raised annually with a 5 percent tax.”

The substance abuse prevention fund idea would put that $100,000 in a single fund, from which grants would be awarded to organizations such as GCSAPP, the Marshal’s Office, Parks and Recreation and more.

“That could add to the budgets of multiple organizations that typically play the grant game with fewer opportunities and more competition from state and federal grant programs,” Kuehlhorn explained.

“This is an opportunity for us, as a community, to recognize the important role many organizations play in our community and to commit to supporting them for the long term.

GCSAPP is running into grant hurdles and Kuehlhorn said this could help keep the GCSAPP programs running if they lose some grant dollars. Grants seem harder to get for a lot of organizations; Kuehlhorn sees this excise tax as a chance for stability.

“We already allow marijuana sales into our town, so let’s offset some potential costs to substance abuse [that is happening] in our town with a revenue source that taxes only those who choose to use,” Kuehlhorn said. “Maybe it creates revenue to finally develop a teen hangout for Friday and Saturday nights. High school kids always ask for this and what have we created? Nothing, yet. Let’s listen to the youth. They seem to be kind of smart.”

Kuehlhorn’s email encourages citizens to call or write their council representatives: “GCSAPP is advocating for our kids and encouraging town staff and council members to earmark excise taxes from marijuana sales for a Substance Abuse Prevention Fund. This is a true opportunity to take a stand and impact the future of many grant-funded programs in our valley that support our kids’ development. Why would we pass this up?”

“Spurring the conversation will help ensure the better decision gets made as the opportunity exists,” Kuehlhorn concluded.

The Crested Butte News Serving the Gunnison Valley since 1999

The Crested Butte News Serving the Gunnison Valley since 1999