“An encouraging decision”

A Gunnison County rancher took on the Internal Revenue Service and won in a court case to determine the value of a conservation easement. Two local land trust administrators feel the ruling could help give confidence to area landowners who are looking to put property into a conservation easement.

The ruling, filed May 6 by U.S. Tax Court Judge Robert Wherry Jr., will still require rancher Nick Hughes to pay the IRS an additional $437,153 in federal taxes.

The IRS had audited Hughes after he filed his 2000 taxes with a $3.1 million charitable contribution for 2,413 acres he had donated to Black Canyon Land Trust Inc. The land was placed in a conservation easement to protect it from future development.

The IRS countered that the donated land was worth between $0 and $238,135, and not more than $3 million as claimed by Hughes, according to expert testimony from the IRS included in the ruling.

But Judge Wherry disagreed and overruled the IRS, placing a value of $2 million on the land. Hughes will now have to pay taxes on the remaining $1.1 million.

Hughes’ attorney Joseph Thibodeau told the Denver Post, “It was a given that the contribution was allowable. The only issue was the amount [the land was worth].”

The case had drawn the attention of conservation easement advocates from across the country and even appeared in blogs as far away as the United Kingdom.

By placing land in a conservation easement, landowners can often maintain access to the property for agricultural use, remove the land from their list of taxable assets and get tax credits for donating the easement to a charitable organization, like a land trust.

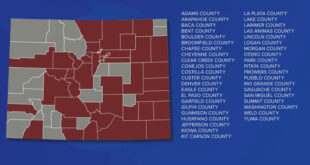

During the previous presidential administration, the easements became a focus of IRS scrutiny and in that administration’s first year, almost three-quarters of the easement-containing tax returns that were audited nationwide were in Colorado, according to the Land Trust Alliance.

Lucy Goehl, executive director of Gunnison Ranchland Conservation Legacy, said there have been several audits of conservation easements conducted by the IRS in Gunnison County, “but they’re all over the state and Gunnison County is not exempt from that.”

The ruling pointed out that the IRS engineers evaluating conservation easements are not certified appraisers, who are the only professionals able to place a value on property donated as a conservation easement.

“I think the fact that the court gave very little weight to the matrix the IRS was using in valuing the land makes this an encouraging decision,” said Goehl. In response to that part of the ruling, the IRS asked the Colorado Division of Real Estate to grant their engineers certified appraiser status.

Ann Johnston, executive director of Crested Butte Land Trust, thinks the ruling will have an indirect affect on the trust’s efforts to preserve open space by giving legitimacy to the idea that land held in a conservation easement still has value.

“What I’m hoping will happen here is that when these programs in Colorado go through cases like this, it’s showing that the programs are valuable and it could encourage people to donate land,” she said.

Although the ruling encourages her, Goehl points out that most conservation easements and appraisals are “legitimate deals done according to the law.”

“This is one encouraging decision, but there are a lot of cases out there,” she said.

The Crested Butte News Serving the Gunnison Valley since 1999

The Crested Butte News Serving the Gunnison Valley since 1999